Beyond the Consensus: The 2025 Asset Allocation Award Winners

Inside the strategies of five top-performing asset managers, and why their caution may prove their greatest strength.

Following the publication of the Asset Allocation Consensus, in which Alpha Research shares the most recent market views, it’s time to look at the five winners of the 2025 Asset Allocation Awards.

These asset managers have demonstrated a proven track record and consistency in their investment decisions. Their views tell a story that deserves attention — one that gives color to the consensus and shows how active management adds value in practice.

In this overview, we explore the reasoning behind each winner’s positioning.

Vontobel: Quality Over Quantity

(Winner – Asset Allocation Award 2025)

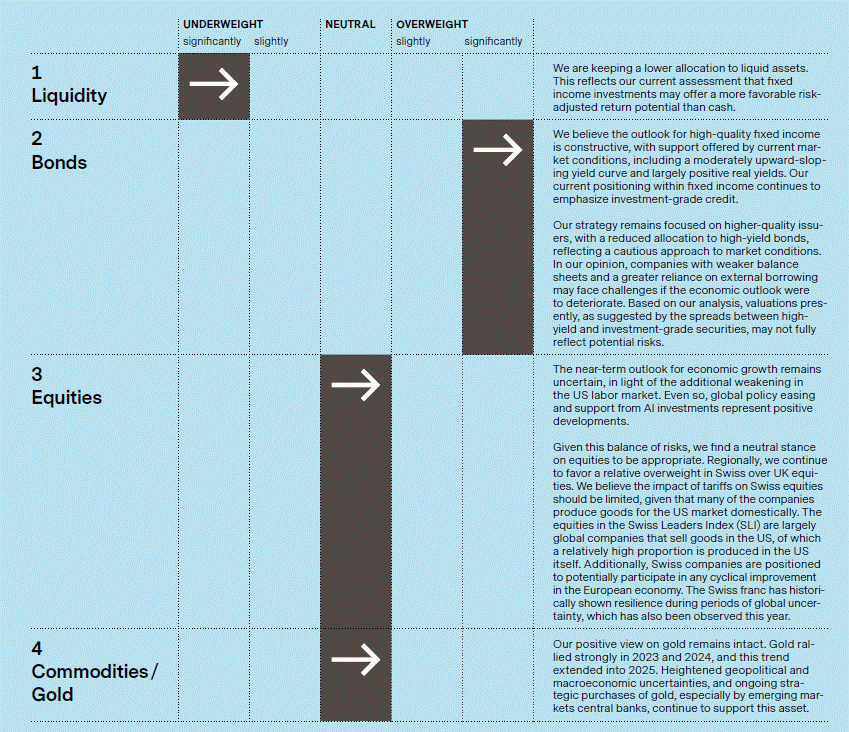

As I read it, Vontobel took a deliberate contrarian stance in October 2025. While the consensus remains underweight in bonds, Vontobel has shifted to overweight, a notable turning point from caution toward renewed confidence in high-quality fixed income.

The reasoning is clear. The Fed cut rates for the second time this year and signaled further easing in 2026, moving policy from restrictive to neutral. According to the Vontobel Investors’ Outlook (October 2025), this creates opportunities because “the outlook for high-quality fixed income is constructive, with support offered by current market conditions, including a moderately upward-sloping yield curve and largely positive real yields.”

What I appreciate is that Vontobel doesn’t chase growth acceleration but focuses on valuation and stability. Their emphasis on investment-grade bonds reflects a disciplined risk assessment, avoiding exposure to companies “with weaker balance sheets and a greater reliance on external borrowing.”

In equities, they remain neutral while the consensus is overweight, waiting for “better fundamental visibility” before adding risk, a balanced stance where discipline outweighs enthusiasm.

Read the full Investors’ Outlook here.

J. Safra Sarasin: Cautious When Others Cheer

(Winner – Equities Regional Award 2025)

While Vontobel stands out for its conviction in bonds, J. Safra Sarasin distinguishes itself through caution on U.S. equities.

In the latest Alpha Research Consensus (1 November 2025), 48.3% of reports are overweight on the U.S., 40.3% neutral, and only 11.3% underweight — with bullish sentiment rising sharply last month. Sarasin, however, stays neutral.

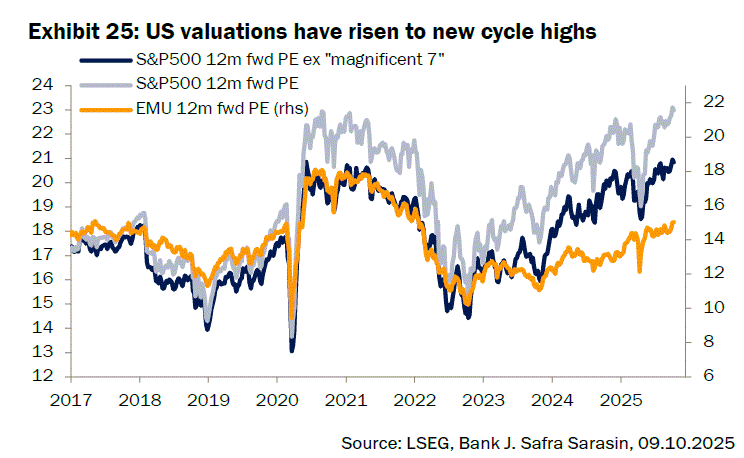

In its Cross-Asset Weekly (10 October 2025), the firm writes that “U.S. equity valuations have broken out of the range they had been in over the past five years and are now trading at the highest price-to-earnings ratio since 2000.” That’s not just a warning — it’s an observation that much of the AI-driven optimism is already priced in.

While AI and fiscal stimulus support growth, Sarasin cautions that upcoming earnings “could be a source of volatility.” Their preference for defensive sectors such as healthcare and Swiss equities underscores a focus on quality over momentum.

Read the full Cross-Asset Weekly here.

ING Investment Office: Calm in a Nervous Market

(Multiple winner – Equities Sectors Award 2025)

After Sarasin’s regional focus, we turn to the sector view of ING Investment Office, which won the Equities Sectors Award for the third time, and for good reason. Their sector strategy remains grounded in valuation discipline, even in a year fueled by enthusiasm over AI and rate cuts.

What stands out is their underweight in Utilities, whereas the consensus is overweight. According to the Maandbericht Beleggen (November 2025):

“Equity valuations have risen sharply. The bar is getting higher, leaving little room for disappointment.”

Utilities, often considered defensive safe havens, can be hit hardest when high expectations meet reality.

ING is also cautious on Industrials, citing slower growth and geopolitical risks: “The strong euro and U.S. import tariffs are weighing on European exporters.” Conversely, they have become slightly more positive on Materials, upgrading from underweight to neutral as demand from China and the U.S. recovers.

Their approach exemplifies consistent active management: rational, not reactive.

Read the full Maandberichten Beleggen here.

Nuveen: Optimistic on Bonds, Selective on Credit

(Winner – Fixed Income Award 2025)

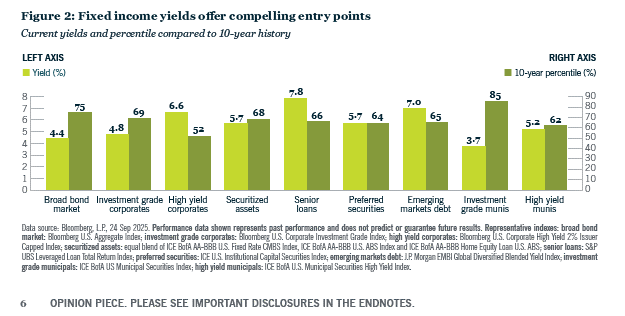

Like Vontobel, Nuveen is constructive on fixed income, a stance that stands out in a market where consensus remains underweight.

According to their Global Investment Committee Outlook (Q4 2025), “current yields remain very attractive, credit fundamentals are strong and investor demand for fixed income assets remains elevated.”

Their conviction rests on three pillars:

Falling rates, restoring the value of duration as a growth hedge.

Strong credit quality, with defaults remaining low.

Attractive valuations across select segments.

Nuveen is more cautious on Investment Grade (“spreads are extremely tight”), neutral on High Yield, and overweight in Emerging Market Debt, supported by improving fundamentals and a softer dollar.

“Emerging markets debt has grown increasingly attractive... while senior loans and securitized assets offer yields at extremely attractive entry points.”

Read the full Global Investment Committee Outlook (Q4 2025) here.

Northern Trust AM: Liquidity as a Strategic Anchor

(Multiple winner – Asset Allocation and Overall Awards)

Finally, Northern Trust AM, a consistent top performer across asset allocation, regional, and fixed income categories. Their strength lies in the disciplined use of data and timing.

What stands out this quarter is their overweight in cash, while the consensus remains underweight. Their view, detailed in the Investment Perspective (October 2025), is that liquidity is not a defensive shelter but a strategic tool.

“Greater volatility is likely not a bug of the current trade stand-off but a feature of the emerging geopolitical landscape.”

In a world where both the AI rally and U.S.–China tensions inject volatility, cash provides flexibility and resilience. Northern Trust AM also remains cautious on real assets — “the repricing of real estate assets has created a challenging environment” — explaining their underweight in real estate versus the neutral consensus.

For Northern Trust AM, cash is not idle capital, it’s readiness.

Read the full Investment Perspective here.

Conclusion

What unites these five Asset Allocation Award winners is their ability to combine optimism with judgment. This isn’t a simple “risk-on” posture: they see opportunities in bonds, AI-driven equities, and emerging markets, yet remain sober about valuations and risk.

For some, cash is not a parking place but a strategic buffer; for others, real estate will only regain appeal once rates fall further.

Where the consensus provides direction, these winners add conviction and nuance. Their strength lies not in following trends but in recognizing when caution itself becomes the foundation for solid returns.