The Market Votes for Returns

The monthly Asset Allocation Consensus update – insights, trends, and surprises from 65 strategy reports.

In the Netherlands, the votes have been counted, the exit polls analyzed, and the results announced. Time for interpretation, nuance, and, of course, discussion. At Alpha Research, we do much the same thing each month, not with voters, but with asset allocation reports.

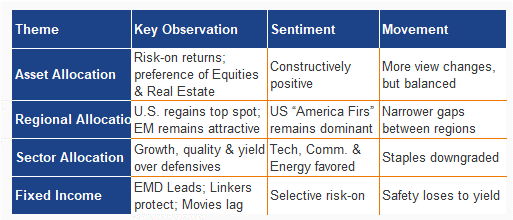

Over the past month, we entered 65 reports into our database, resulting in 63 view changes for the coming 3 to 12 months. That’s up from 47 in the previous month, or, in election terms, a higher voter turnout. Yet there was no landslide: 52.4% of the changes were upgrades (positive adjustments), and 47.6% were downgrades. Optimists and pessimists balanced each other perfectly.

The only clear shift appeared in regional allocation, where most strategists raised their exposure. And if one “party” lost votes, it was among equities: Consumer Staples moved from neutral to underweight.

These 65 reports come from asset managers collectively overseeing around €61.6 trillion in assets, a rather significant mandate. So yes, every vote counts. The Consensus remains an excellent starting point for understanding where the market places its confidence.

Let’s begin with the first round of votes: how does the market distribute its seats across equities, bonds, and alternatives?

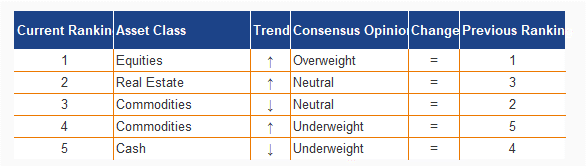

💡 Asset Allocation

After counting all the votes in the Consensus, a clear picture emerges of where the market’s confidence lies. The ranking among the main categories shifted slightly: Real Estate gained attractiveness, climbing to second place, while Commodities slipped. Bonds improved modestly, and Cash is now officially the least attractive asset class. The tone is set, strategists are leaning risk-on, not aggressively, but noticeably.

As with elections, turnout tells only part of the story, interpretation matters more. This month’s data shows less noise and more direction. Strategists appear more confident and differentiated in their positioning. The balance between upward and downward revisions suggests a selective reallocation toward areas where returns are still to be found.

The Storyline of the Month

This month’s theme is constructive risk-taking. Investors are cautiously increasing exposure to risk assets as long as the macro narrative holds. The optimism is clearest in equities, supported by improving earnings momentum, AI-driven growth, and valuation recovery in emerging markets, while cash sinks to a historical low in attractiveness. The contrast is striking: equities represent opportunity, cash represents inertia.

Strategists are moving a step toward risk, but in a measured, data-driven way. The market’s message is not “everything must rise,” but rather: “cash has become too expensive to do nothing.”

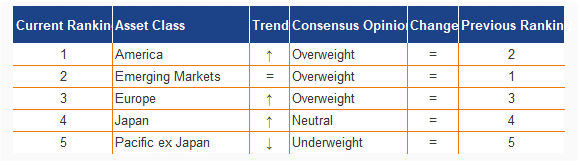

🌍 Regional Allocation

After the broad asset overview, focus shifts to regions, and there’s a clear winner. The United States has reclaimed the top spot, pushing Emerging Markets into second place. The rest of the field remains stable: Europe, Japan, and Pacific ex-Japan sit at the bottom, with the latter two still viewed as least attractive.

The gap between regions has narrowed, reflecting a more balanced risk perception. Strategists are shifting away from a black-and-white view (“America good, rest bad”) toward a more nuanced outlook. Europe and Japan are gradually improving, Emerging Markets remain solid, but conviction still lies firmly across the Atlantic.

The Storyline of the Month

The U.S. is regaining leadership, not through euphoria, but through fundamentals. Broader earnings growth, AI-driven productivity gains, and macroeconomic resilience give America a solid tailwind. Fed rate cuts and pro-growth policies reinforce this trend, while the quality of U.S. large caps, with their strong balance sheets and pricing power, continues to inspire confidence.

In contrast, Pacific ex-Japan struggles with a lack of catalysts, as Australia’s weaker outlook weighs on sentiment. Overall, global allocation is slowly rebalancing, but the U.S. remains in command. “America First” is proving not just a political slogan, but also a market reality.

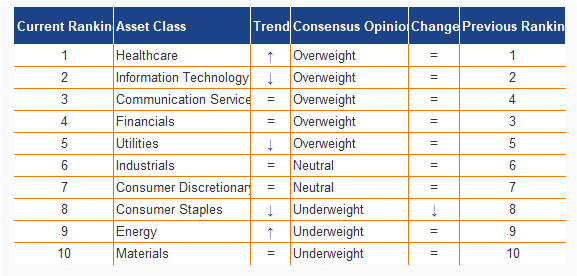

🏭 Sector Allocation

Next up: sectors, and here, calm prevails. Only one real consensus change: Consumer Staples drops from neutral to underweight. Otherwise, the moves are minor: Communication Services climbs one spot while Financials slips slightly.

Beneath the surface, there’s more movement than the table suggests. The most positive revisions appeared in Energy and Healthcare, while Consumer Staples and Utilities lost some ground. The trend points toward sectors combining growth, quality, and yield, the key mix defining 2025.

The Storyline of the Month

This month’s narrative is one of targeted reallocation within a stable landscape. The focus is shifting from defensive consumption sectors toward cyclical and thematic plays. Energy is regaining attention as a valuation alternative, while capital rotates away from Staples toward AI-driven themes and dividend yield opportunities in Utilities and Communication Services.

The pattern mirrors the broader equity picture: investors are increasingly favoring growth and return over safety. The market is no longer voting for security, but for performance. And that, in one line, sums up the investment year 2025.

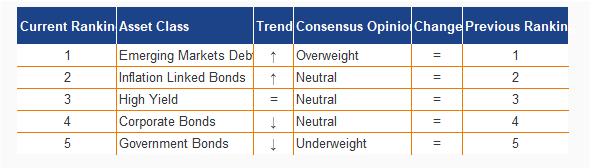

💵 Fixed Income

Finally, fixed income, historically the calm corner of portfolios, but not without movement this month. No changes in the consensus ranking, yet Emerging Market Debt (EMD) remains the clear favorite, while Government Bonds stay the only underweight segment. October brought positive returns across all categories, with EMD leading the pack.

The Storyline of the Month

Within fixed income, the message is consistent: return over safety. Government bonds are losing their traditional shine amid higher term premia, fiscal concerns, and persistent rate volatility. Meanwhile, Inflation Linked Bonds are regaining appeal, supported by attractive real yields and their asymmetric protection profile.

As I used to say, “Inflation is just around the corner.” These days, inflation seems impossible to ignore, stubbornly sticking around. Investors are therefore prioritizing return, diversification, and inflation protection over blind trust in “safe” government paper.

📊 Summary – Asset Allocation Consensus November 2025

In short: the market is no longer voting for safety, but for return, perhaps the most predictable outcome of the year.

🏆 Looking Ahead

In the next publication, we’ll spotlight the Asset Allocation Award winners:

Vontobel

Nuveen

J. Safra Sarasin

ING Investment Office

and Northern Trust AM.

Over the past three years, these firms have consistently outperformed the consensus, not by following it, but by daring to differ. While the average view stayed in the middle, they positioned with conviction. That’s why their reports deserve closer attention: they’re the ones to watch if you want to see where the market truly leads, not follows.

Soon, we’ll explore how they diverge from the consensus, where they’ve been right, and what their current positioning implies for the year ahead.

Stay tuned, the most interesting deviations are coming soon.