The Solution: Stop Seeing Gold as Metal — Start Seeing It as a Mirror

Why gold deserves a place in every portfolio, and why 0% is the wrong number.

During the Global Financial Crisis, I worked for a Belgian wealth manager.

They had 10% gold in their portfolio.

I worked for the Dutch branch, we had 0%.

That difference says it all.

Not about performance, but about mentality.

The Dutch trust their currency and their government.

We’ve never gone bankrupt, never experienced hyperinflation, and we believe risks can be managed away.

Belgians, with a different financial history, see gold as protection.

As a Dutchman, I know the feeling, if it’s not in the risk model, it can’t possibly go wrong.

And that’s where my story begins.

Because ignoring gold is not just ignoring an asset class, it’s ignoring the reality that crises always come back, no matter how comfortable your DNA feels.

🧠 What Gold Really Is

I don’t see gold as speculation; I see it as diversification with character.

It belongs in a portfolio designed to survive scenarios we’d rather not imagine.

Gold:

produces nothing (just like cash or some commodities),

pays no dividend,

but preserves value, often better than inflation, over decades.

You could argue it only pays off in a crisis.

But sometimes you need to wait for that crisis, and that’s the point.

Wait long enough, and the inflation hedge comes for free.

💡 My View

A portfolio without gold is incomplete. 0% is the wrong number.

In times of war, geopolitical tension, and structural inflation, investors shouldn’t ask if they need gold, they should ask how much.

Gold isn’t a performance engine; it’s what Nassim Nicholas Taleb would call an antifragile element, something that doesn’t merely survive volatility but benefits from it.

In an increasingly fragile financial world, gold remains one of the few assets that gets stronger when everything else starts to crack.

😩 Why Investors Still Avoid Gold

Investors don’t avoid gold because it performs badly.

They avoid it because it doesn’t fit their worldview.

In the Netherlands, the dominant belief is: “We’re in control.”

In Belgium, it’s more like: “Control is temporary.”

That cultural reflex shapes portfolios more than any model.

If you believe “it’ll all work out,” gold feels like dead weight.

If you’ve seen systems fail, gold feels like insurance.

✍️ What Ray Dalio Says, and Why It Matters

In his recent article My Answers to Your Questions About Gold,

Ray Dalio describes gold not as a metal, but as the oldest and most reliable form of money.

His main points are striking:

💰 Gold is money, fiat currency is debt.

🧩 Gold performs when stocks and bonds fail.

⚖️ A 10–15% strategic allocation optimizes the risk-return ratio.

🏦 Central banks are cutting Treasuries and adding gold.

📉 Since 1750, 80% of currencies have disappeared or been devalued.

That flips the traditional definition of “riskless asset”:

“Compared to Treasuries or any other fiat currency debt, gold is the more riskless asset.”

A bold statement, understandable in the U.S., with debt/GDP over 120%, but less directly applicable in Europe.

Still, he’s right about one thing: real risk isn’t always where we measure it.

I must admit, Dalio’s skepticism toward inflation data strikes a chord with me.

In 2025, the U.S. Bureau of Labor Statistics went through a very public scandal after major revisions to employment numbers and the dismissal of its commissioner.

It reminded me how easily even “hard data” can become soft politics.

We like to think of inflation figures as objective, but they’re built on shifting baskets, delayed updates, and, sometimes, political convenience.

Yet for European investors, I think it’s not “either-or.” It’s “both-and”:

a little gold,

a little inflation-linked bonds,

and no blind spots for what doesn’t fit neatly in Excel.

📈 The Alpha Research Consensus on Gold

The Alpha Research Asset Allocation Consensus confirms that gold is no longer a fringe view.

At present, 56% of strategists are overweight gold, 38% neutral, and only 6% underweight.

Today, more than twenty firms actively include it in their 3-to-12-month Tactical Asset Allocation outlooks, a clear sign that gold has re-entered the mainstream of professional portfolios, even if it’s still absent from some traditional asset allocation frameworks.

That’s a sharp contrast to five years ago, when barely five asset managers expressed a tactical view on gold.

When reviewing the consensus reports, five key drivers consistently explain gold’s performance outlook:

Inflation: Gold tends to perform best when inflation exceeds 5%.

Real interest rates: Negative real yields boost gold demand.

Geopolitical tension: Gold acts as a safe haven in crisis periods.

Central bank demand: Persistent buying supports structural strength.

Dollar weakness: Increases international demand and price momentum.

In short, the consensus view on gold has matured, it’s no longer just an emotional hedge, but a data-backed position rooted in macro reality.

Interestingly, this growing confidence in gold coincides with renewed attention to Inflation-Linked Bonds within fixed income portfolios.

While ILBs hedge inflation through coupons, gold protects against the system itself, monetary policy, credibility, and confidence.

Both serve different purposes, but together they form a pragmatic “real assets” defence in an environment where inflation risks remain sticky.

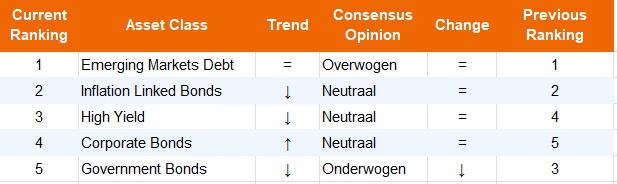

📊 Fixed Income Consensus Table

💬 The October ranking, with Emerging Market Debt leading, Inflation-Linked Bonds rated Neutral.

🌍 Today’s Context

We live in an era of new certainties:

war in Ukraine,

NATO’s 5% spending norm (3.5% for defense, 1.5% for infrastructure),

reindustrialization,

persistent wage and commodity pressure.

Inflation isn’t going away. To preserve wealth, investors must take risk, but also build in breathing room.

Gold isn’t hype. It’s oxygen for your portfolio.

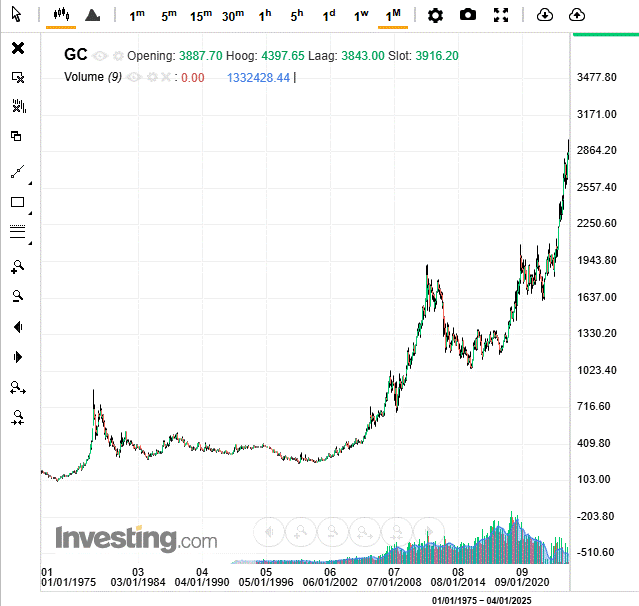

📉 Gold Price Chart 1975–2025

GFC 2008, pandemic 2020, Ukraine 2022. Caption: “Crisis reminds, gold reacts.”

🪙 Conclusion – The Real Mistake

The mistake isn’t buying gold too late.

The mistake is forgetting gold altogether.

It’s not about timing; it’s about scenario thinking.

And in every scenario, one truth remains:

A portfolio without gold is the wrong kind of certainty.