The Signal Within the Noise: What Sets 2025’s Asset Allocation Award Winners Apart

Five leading houses, five distinct allocation calls, each grounded in data, discipline and a willingness to diverge from consensus.

Each month, we review the Asset Allocation Awards from early 2025 and analyse the recommendations and reasoning of the winners. What matters most is why these successful asset allocators make the choices they do. This month’s consensus is based on 68 TAA reports with an investment horizon of three to twelve months. Several interesting differences stand out. It is rare for an investor to be fully aligned with the consensus, and this also applies to the Asset Allocation Award winners. We begin with the overall winner and then work through the key categories.

1. Northern Trust AM – Overall Winner

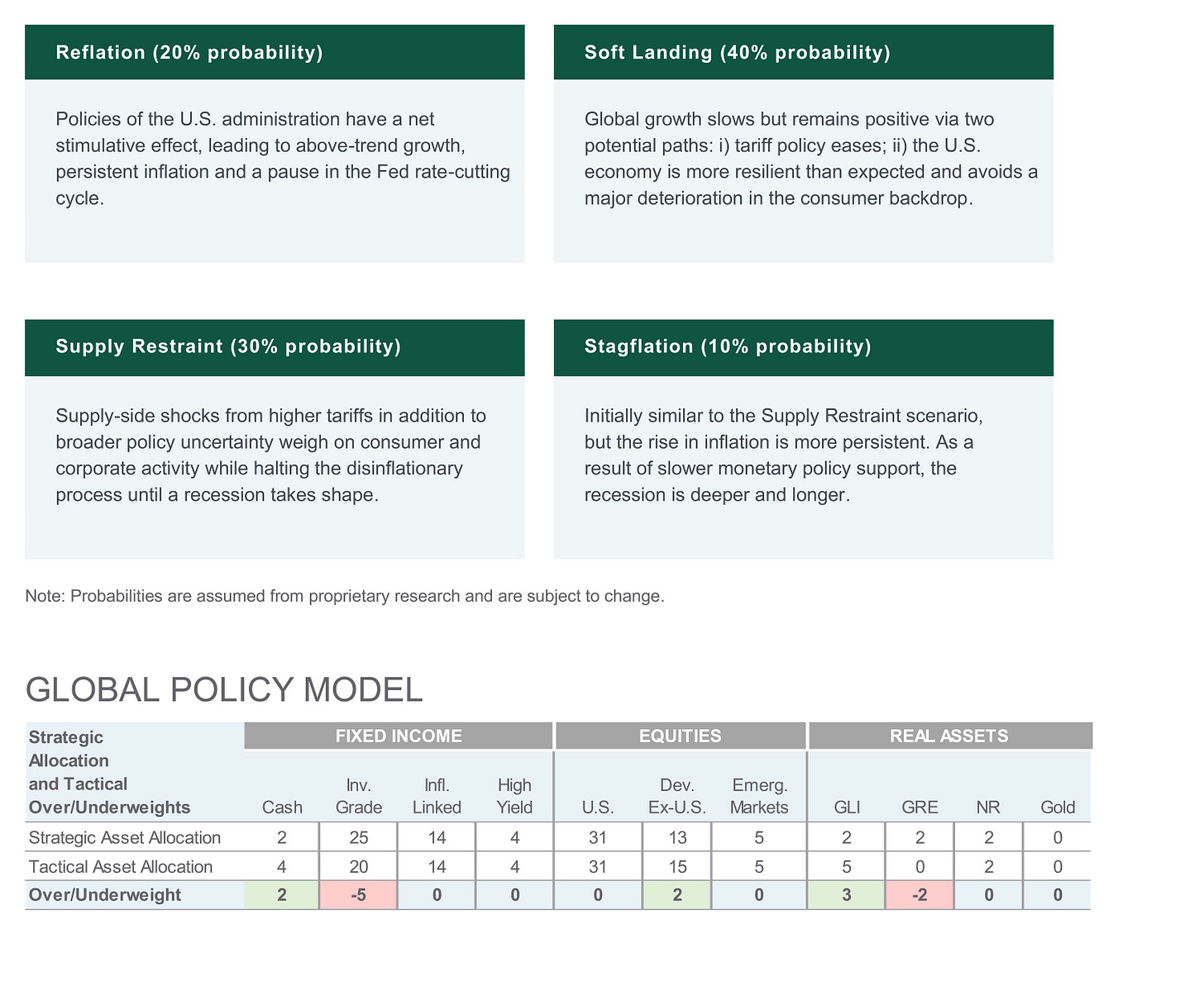

Northern Trust AM won the Overall Asset Allocation Award again earlier this year, reaffirming their reputation as one of the most consistent and convincing asset allocators. In their recent Investment Perspective – November 2025, the most striking element is their overweight position in cash, a clear contrast with the consensus, which views cash as the least attractive asset class.

Northern Trust does not see cash as an endpoint, but as strategic liquidity. In the Investment Perspective – November 2025, they highlight persistent uncertainty around the interest-rate path, limited compensation in investment-grade credit, and increasingly fragile market sentiment in which risks can shift quickly. Cash provides optionality in a phase where opportunities may suddenly arise.

Their stance on real estate also differs from the consensus. While the consensus is neutral, Northern Trust maintains an underweight. Their report clarifies that the repricing process is still ongoing, financing costs remain elevated, and capital continues to flow toward alternative illiquid asset classes (such as private credit). Their underweight is the result of a clear risk assessment.

2. Vontobel – Asset Allocation Award Winner

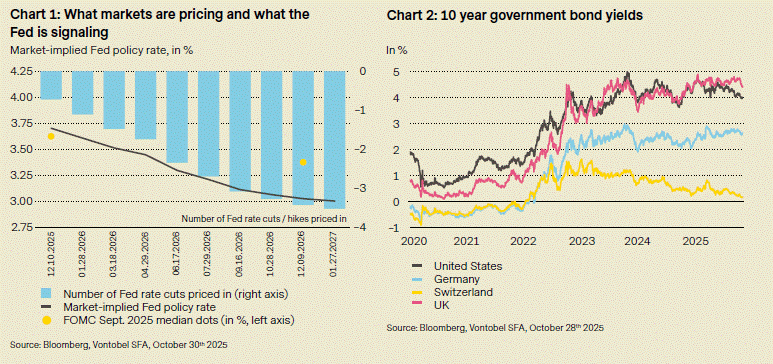

Vontobel, which won the Asset Allocation Award in February, presents in their Investors’ Outlook – November 2025 a perspective that diverges meaningfully from the TAA consensus. While the market holds an underweight in bonds, Vontobel opts for an overweight, and where the consensus maintains an overweight position in equities, Vontobel instead assigns a neutral rating.

In the Investors’ Outlook, Vontobel explains their preference for bonds by pointing to a constructive interest-rate environment, positive real yields, and an upward-sloping yield curve. They emphasise quality, favouring investment-grade credit while downshifting high yield due to tight spreads. According to Vontobel, for the first time in years, bonds offer more attractive risk-adjusted returns than equities.

For equities, Vontobel deliberately maintains a neutral stance. Uncertainty around economic growth, particularly potential weakening in the US labour market, combined with elevated valuations after years of strong equity-market rallies, leads them to see less upside than the consensus. AI-related investments remain supportive, but not enough to justify a broad overweight.

3. J. Safra Sarasin – Winner Equity Regions

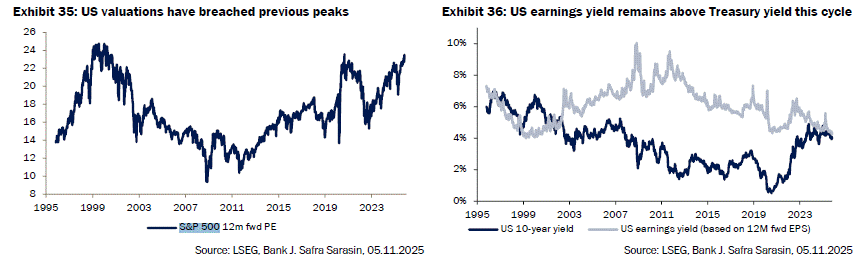

J. Safra Sarasin is the winner of the Equity Regions Award, supported by the analysis in their Cross-Asset Weekly – 7 November 2025. Their regional positioning diverges from the consensus on two fronts.

First, they hold a neutral position in the United States, whereas the consensus remains overweight. In the Cross-Asset Weekly, they highlight exceptionally high valuations , levels reminiscent of the dot-com era, along with a slowdown in earnings momentum. Earnings growth in 2026 is expected to decelerate, while margins face pressure from higher operating expenses and AI-related capital expenditure. As a result, they view the short-term risk-return profile of US equities as less attractive.

Second, while the consensus is strongly overweight Emerging Markets, Sarasin remains neutral. Their report cites several risks: political uncertainty in Latin America, divergence in growth dynamics across EM regions, and vulnerability to further trade fragmentation. They acknowledge that fundamental tailwinds, such as a weaker dollar and high carry, are positive, but not sufficient to warrant an overweight.

4. ING Investment Office – Winner Equity Sectors

ING Investment Office has won the Equity Sectors Award multiple times and once again performs strongly with the insights from their Maandbericht Beleggen – December 2025. Their sector positioning deviates from the consensus in two notable ways.

For Industrials, ING opts for an underweight, while the consensus is neutral. Although the Maandbericht does not provide explicit sector commentary, the macroeconomic analysis clearly shows that industrial activity in Europe is under pressure, exporters face headwinds from a strong euro and higher trade barriers, and global demand is weakening. This forms an indirect but convincing rationale for their underweight.

For Utilities, ING adopts a more moderate stance: from underweight to neutral, whereas the consensus is overweight. In the Maandbericht, they highlight the structural rise in electricity demand driven by AI data centres and the defensive characteristics of utilities. However, they refrain from moving to an overweight due to valuation considerations and timing uncertainties.

5. Nuveen – Winner Fixed Income Award

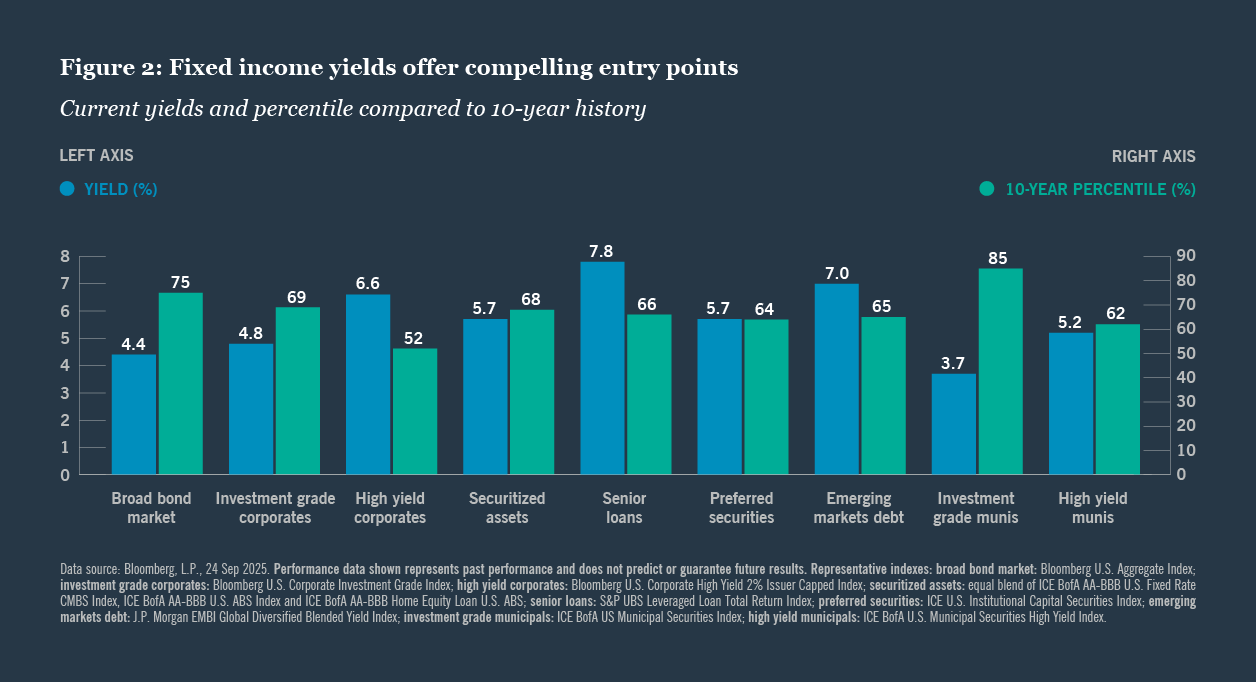

Nuveen won the Fixed Income Award earlier this year, and their view in the report 2025 Q4 Global Investment Committee Outlook – Alternate Routes aligns closely with the consensus. The most prominent example is their overweight in Emerging Market Debt, a category also favoured by most allocation specialists.

In their GIC Outlook, Nuveen highlights three key factors: attractive relative valuations, improving fundamentals, and support from declining US interest rates. The combination of carry, yield, and currency dynamics makes EMD a core position within their fixed-income strategy.

A notable deviation lies in investment-grade credit: the consensus is neutral, but Nuveen opts for an underweight. In their report, they highlight historically tight spreads, long duration profiles vulnerable to rate volatility, and more attractive alternatives elsewhere in fixed income. As a result, they see IG as offering a less efficient risk-return profile than, for example, securitized assets or senior loans.

Conclusion

The five award winners, each with a strong track record, support all their recommendations in their own style and research tradition. This demonstrates that investing is not only about having a view but also about presenting a clear and consistent narrative. Their reports make visible how these perspectives are formed: Northern Trust through risk management, Vontobel through valuation discipline, Sarasin through regional nuance, ING through sector logic, and Nuveen through fixed-income depth.