The Consensus That Opens 2026

The December Asset Allocation Consensus Update, trends, and surprises from 68 strategy reports with €63 trillion in AUM

At the end of every year, the asset-management world performs a ritual: the Outlook Season. Podcasts, videos, interviews, and thick PDF outlooks cascade into inboxes worldwide. Strategists fine-tune their models, CIO’s sharpen their narratives, and every firm publishes its most polished vision of the year ahead.

At Alpha Research, we do something simpler, and perhaps more revealing.

We gather all these visions, quantify them, and ask one question:

Where does the market as a whole place its confidence as we enter 2026?

With a record number of reports processed this month, representing €63 trillion in assets, the December Consensus provides the cleanest possible snapshot of how global asset allocators position themselves for the new year.

And the headline is remarkable:

Emerging Markets take the number-one spot in both equities and fixed income.

A rare double leadership position that has appeared only a handful of times since 2012.

The message is unmistakable: 2026 begins with diversification, away from the U.S., and toward global growth.

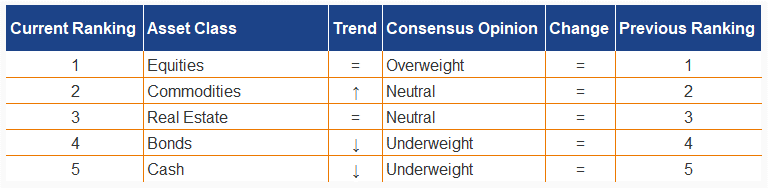

💡 Asset Allocation: No Changes, But Strong Signals

December brought not bring any real shifts in consensus, but that does not mean nothing happened. Sentiment moved beneath the surface, particularly in Commodities (positive revisions) and Cash (negative). The ranking:

Storyline of the Month: 2026 Starts Risk-On

Even without explicit changes, the allocation picture is clear and consistent:

risk assets dominate, and cash has never been less attractive in the 13-year history of this dataset.

Equities stay firmly in the lead, and the distance between Equities (top) and Cash (bottom) remains extreme. The fact that strategists make no last-minute reversals in December, despite a full year of volatility, policy shifts, and macro noise, suggests a high degree of conviction:

The market enters 2026 positioned for return, not for safety.

Real Estate quietly outperformed in November, and Commodities received the most positive sentiment adjustments. Cash, in contrast, was once again the least popular place to hide.

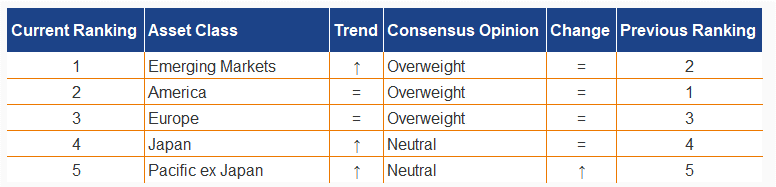

🌍 Regional Allocation: Emerging Markets Take the Crown

Here was one change: Pacific ex-Japan moved from underweight to neutral.

The full ranking now stands:

The headline: Emerging Markets has overtaken the United States as the preferred region.

This is not valuation-driven. Based on expected returns, we see in the building block valuation that EM does not have a valuation problem here, whereas this is clearly an issue for US equities. The data show:

EM sentiment is now in the top 10% of historical observations since 2012.

Conviction strengthened throughout 2025, supported by better fundamentals and improving macro visibility.

The U.S., while still overweight, saw small downgrades and remains well below its historical highs.

Storyline of the Month: The Year of Global Diversification

If 2025 had a theme, it was simple: The market diversified. The U.S. lost relative dominance, Europe stabilised, Japan improved, and Emerging Markets steadily climbed. December confirms that trend decisively:

2026 begins with Eerging Markets in pole position

A rare and important signal, and one that aligns perfectly with fixed income (see

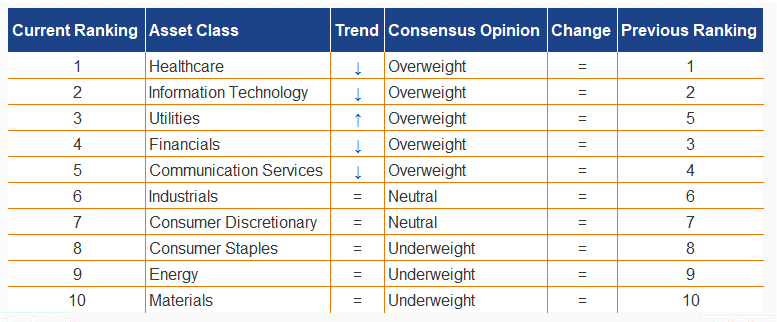

🏭 Sector Allocation: Utilities Surprise, Quality Leads

No consensus changes in December, but the ranking shifted only slightly:

Utilities climbed from 5 → 3, supported by strong positive revisions.

Communication Services received the most negative adjustments but remains historically elevated. The structure is now:

Storyline of the Month: Defensive Growth Takes the Stage

Utilities reaching a historically high conviction level (only four months ever higher) shows how strategists navigate a late-cycle environment:

stable cashflows

bond-like characteristics

but with equity-like optionality

and supported by strong YTD performance

Energy and Materials remain the structural laggards in both sentiment and performance.below).

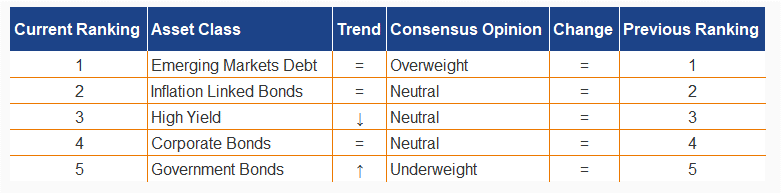

💵 Fixed Income: Emerging Market Debt Still #1

he December ranking remains unchanged:

YTD, EMD is still the only segment with a positive return in 2025. But the most revealing signal lies not in the individual categories, but in the order itself.

A Ranking That Is the Mirror Image of the Risk Spectrum

When you place the five categories on a traditional fixed income risk ladder…

Lowest risk: Government Bonds

Corporate Bonds

High Yield

Higher risk: Inflation Linked Bonds (due to duration/real-rate sensitivity)

Highest risk: Emerging Market Debt

…you would expect a conservative consensus at year-end, especially heading into a new cycle. Yet the Consensus does the opposite.

The ranking is essentially the reverse of the fixed income risk spectrum.

Government Bonds, the safest asset, sit firmly at the bottom.

Corporate Bonds and High Yield occupy the middle.

Inflation Linked Bonds remain elevated.

And Emerging Market Debt, the riskiest segment, holds the #1 position for another month.

This inversion is not a coincidence. It is the combined outcome of 68 strategy reports, all written during Outlook Season, all finalised with a clear 2026 horizon.

Storyline of the Month: EM Leads on Both Sides of the Balance Sheet

When both EM equities and EMD sit at the top of their respective rankings, it signals something beyond carry or valuation:

The market believes that global growth drivers in 2026 will increasingly originate outside the U.S. and Europe.

The preference for EMD over Government Bonds underlines another trend of 2025 that continues into 2026:

less emphasis on duration

more emphasis on income

selective risk-taking in regions with improving fundamentals

This is not a pursuit of returns, but it resembles a shift in perceived macroeconomic leadership.

📊 Summary: The December 2025 Consensus

This is the consensus that opens 2026. It is calm on the surface, but decisive underneath. Across all categories, one message stands out:

Emerging Markets is the preferred place to generate returns in 2026: in both equities and bonds.

That is rare. That is meaningful. And it marks a clear departure from the post-2010 playbook that centered almost exclusively on the United States.

The broader picture remains unequivocally risk-on, with cash at a historical low and no evidence of a defensive turn heading into the new year.

Looking Ahead: Winners Wednesday

As every month, this week’s Winners Wednesday will spotlight the Asset Allocation Award winners:

Vontobel

Nuveen

J. Safra Sarasin

ING Investment Office

Northern Trust AM

These asset managers have consistently outperformed the Consensus by not following it blindly, but by diverging with conviction.

On Tactical Tuesday, all links will be posted so readers can dive directly into the source material.

On Winners on Wednesday, we break down how these firms’ views differ from the crowd, and what that might mean for 2026.