Government Bonds or EM Debt? The Tactical Split That Defines Today’s Fixed Income

Tactical Tuesday: positioning portfolios when the short-term really matters.

Within Fixed Income, one question keeps resurfacing: do you opt for the defensive safety of developed-market government bonds, or the higher carry offered by Emerging Market Debt? Inflation in Europe remains above target, making real returns difficult to achieve. With low duration risk, coupons remain slim, yet taking more risk still feels uncomfortable for many investors.

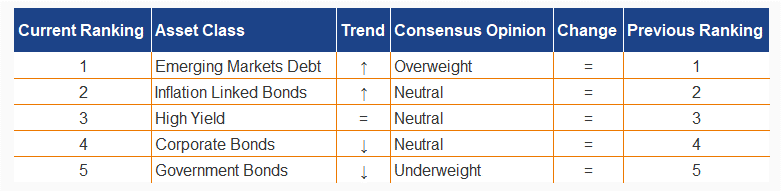

Consensus data illustrates this tension clearly. Looking back at the Asset Allocation Consensus since its launch in 2012, strategists and CIOs favoured Government Bonds over EMD in only 5 out of 156 months. A clear structural preference for Emerging Markets, while in practice, portfolios still lean heavily on developed-market government bonds. And the latest November data once again shows a convincing preference for EMD.

Source: Alpha Research, November 2025

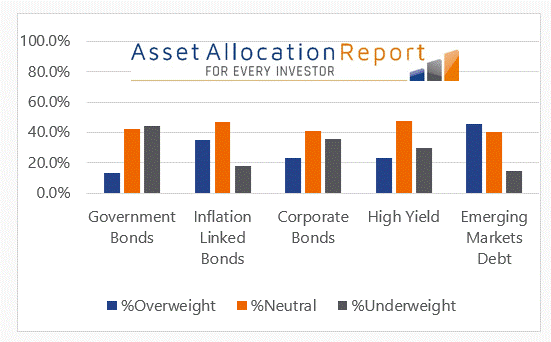

When we examine the distribution of overweight, neutral, and underweight recommendations, EMD stands out: the percentage of overweight calls is higher than in any other Fixed Income category, while the percentage of underweights is the lowest among the more than 60 experts surveyed.

Source: Alpha Research, November 2025

In this context, Emerging Market Debt refers specifically to hard-currency EMD, where returns are driven mainly by higher spreads and early rate-cutting cycles in many EM countries. Fundamentals, debt levels, fiscal discipline, and demographics, often look better than sentiment suggests. Still, indirect FX risk never fully disappears: a stronger US dollar, shifting global liquidity, or sudden capital-flow reversals can all impact performance.

Yet the core challenge remains unchanged: without taking risk, it is nearly impossible to earn real returns in Fixed Income. Over the past five and ten years, no Fixed Income category delivered a positive total return in euros, while inflation eroded a significant part of the coupon.

This brings us to the tactical decision:

Defensive and macro-driven? Developed-market government bonds offer the first line of protection once rate cuts come into view and volatility rises.

Seeking returns? EMD provides what the rest of Fixed Income currently lacks: carry, diversification, and an earlier position in the global monetary cycle.

Conclusion: in an environment where inflation remains sticky, the US dollar stays relatively strong, and central banks have limited room to manoeuvre, Fixed Income requires clear choices. Either you position through duration as a hedge, or you use EM carry as a return driver. The middle ground simply delivers too little today.