Emerging Markets Maintain Their Appeal, Even as America Takes the Lead

Macro Monday: the macro and fundamental forces behind every asset class.

Short Intro

Every Monday I zoom in on one asset class and explore the macro and fundamental drivers behind the consensus. This week, the spotlight is on Emerging Markets, a region that has disappointed for years but is now showing a convincing turnaround.

The U.S. sits firmly in the number one position, yet EM remains solidly overweight in the consensus and offers the highest long-term return expectations of any region. That combination, positive sentiment and strong fundamentals, is rare in EM, and worth examining.

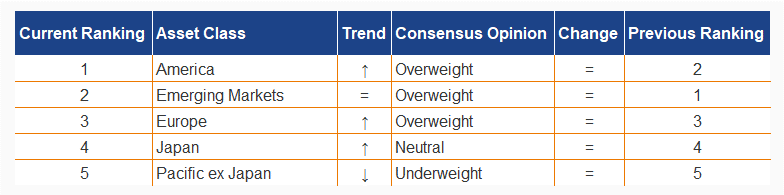

While all eyes remain on the U.S., AI, earnings, mega-caps, the most interesting shift is happening elsewhere. Emerging Markets continue to rank just one step behind America in the consensus:

45.2% overweight

41.9% neutral

12.9% underweight

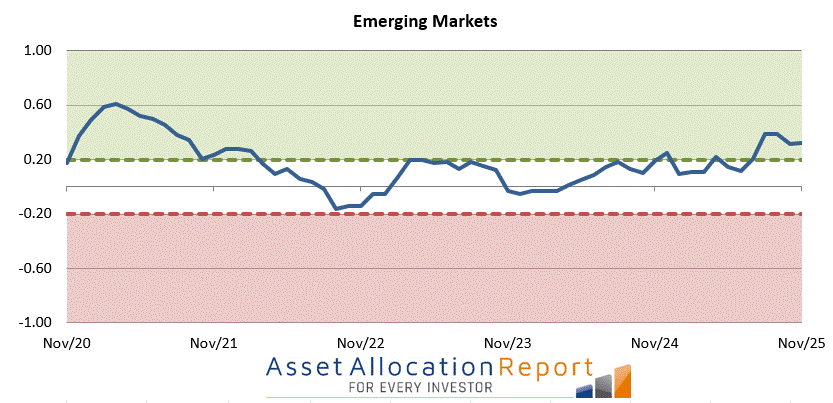

The chart below shows the spread between Overweight and Underweight positions (excluding Neutral). Even during Covid, the indicator never fell below –0.20, meaning there was never a consensus to underweight EM. Sentiment has remained consistently neutral to positive, despite volatility, China headlines, and USD swings.

Allocator lens:

Conviction has been stable. EM has rarely been a “sell.”

Fundamentals: EM Outperforms ACWI in the Building Blocks

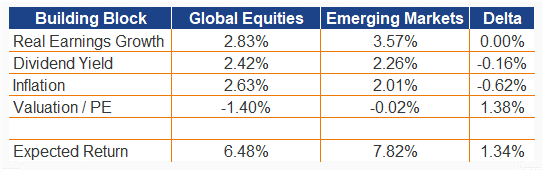

Long-term fundamentals reinforce the tactical picture. In the building blocks, expected growth, valuation, earnings momentum, and re-rating potential, EM clearly outperforms the MSCI ACWI.

This is based on 10-year expected returns, the standard horizon for strategic allocators. EM stands at 7.82%, versus 6.48% for Global Equities.

In short: Short-term sentiment and long-term fundamentals are aligned, something unusual for EM.

Allocator lens:

EM offers both cyclical and structural support.

Why EM Has Become Interesting Again

After reviewing more than 60 TAA reports each month, the dominant arguments from the “overweight” camp fall into four macro-fundamental drivers:

a. USD & global monetary backdrop

A weaker USD historically boosts EM.

With the Fed slowly moving toward easing (and other central banks already ahead), the macro environment is shifting into classic EM outperformance territory.

b. Growth cycle: EM > DM

The industrial cycle is improving across Southeast Asia and Latin America. Commodity exporters benefit from stable or rising prices. The EM–DM growth spread, narrow for years, is now widening again.

c. Valuations: attractive relative to the U.S.

Valuations remain one of EM’s biggest advantages.

China trades at historically depressed multiples, Korea benefits from governance reforms, and several markets combine low valuations with improving earnings.

d. China ≠ EM

The internal divergence within EM is striking:

China struggles with property and geopolitics

India, Taiwan, Brazil, Mexico, and Indonesia show strong earnings momentum

EM today is a diversified set of cycles, not a one-country story.

Allocator lens:

EM’s case does not rest on China alone, important for risk budgeting.

What Can Break the Story?

The most cited risks from the “underweight” camp:

USD risk: a sudden strengthening of the dollar impacts EM quickly

China as a wildcard: structural growth concerns and geopolitics weigh on sentiment

Valuations not cheap everywhere: India/Taiwan are quality markets but expensive

Earnings heterogeneity: diversification cuts both ways

Bottom line:

Buying EM means buying variation. With disciplined allocation, that works. Without discipline, it can hurt.

What Can Break the Story?

The most cited risks from the “underweight” camp:

USD risk: EM is vulnerable to any sudden dollar rebound

China risk: structural growth concerns and geopolitical tensions

Valuations: not cheap everywhere (India/Taiwan are priced for perfection)

Earnings heterogeneity: diversification works both ways

Allocator lens:

Position size matters. EM is attractive, but sizing must reflect its volatility.

Broader Implications for Allocators

EM is one of the few regions where:

sentiment and fundamentals align

valuations still provide breathing room

the growth cycle is improving

re-rating potential is real

reliance on China has decreased

portfolio diversification benefits remain strong versus U.S. quality-growth exposure

EM is therefore a macro-conditional, valuation-supported allocation, not a blind high-beta trade.

When to Overweight and Underweight EM

Overweight EM when:

the USD continues to weaken

global monetary easing accelerates

China deploys meaningful stimulus

the industrial cycle strengthens

commodity prices stabilise or rise

you seek value outside expensive U.S. and Indian markets

Underweight EM when:

the USD unexpectedly strengthens

trade or geopolitical tensions escalate

China disappoints again

valuations in key EM markets become stretched

risk budgets are tight and stability is prioritised

Closing Remarks

Emerging Markets disappointed for years, yet this year, they are the strongest-performing region. There are plenty of arguments to say “this time is different.”

But we also know those are the most expensive words in investing.

Still, based on sentiment, fundamentals, and valuations, EM is better positioned than at any point in recent years. The region deserves a serious place in any tactical allocation discussion.